Brazil: PET helping a rollercoaster year for the package market

Interview with Auri Marçon, president of the PET industry association Abipet

During the height of the Corona pandemic in 2020, companies in the PET value chain were also among those that stopped their operations as a precautionary measure – for a short time. It was not only the continuing high demand for PET bottles that had to be met, but also interruptions in the supply chain for other types of containers such as aluminium, glass or polyolefins which had to be absorbed with PET. And this high demand is not the only good news. There are also positive long-term developments to report in the opening up of new areas of application and the further development of the recycling industry. This is not least due to the work of the Brazilian PET association Abipet.

PETplanet: Mr Marçon, Abipet is the non-profit Brazilian PET Industry Association. Can you please tell us what exactly you do and what your goals are as an organisation?

Marçon: Yes, Abipet is a non-profit organisation integrating the whole industrial steps related to the PET process: virgin resin manufacturers, preforms & bottles converters, sheets and thermoforming producers and recyclers. There is also the technology committee supporting all technical challenges including polymerisation, post-condensation, drying systems, injection, recycling, filtration, transportation, etc. International and local companies are our members: Alpek, Indorama, Amcor, Engepack, Gneuss, Husky, Krones, Piovan, Poly-metrix, 3 Rios, ClearPET, GreenPCR, GlobalPET, Resipol, Lamina and others.

PETplanet: What are the priority issues that are currently driving your agenda and that of your members?

Marçon: Currently our main focuses are on environmental challenges and growing market segments. Just like all over the world the plastic industry is under attack here and not only by environmentalists but also by legislators, governors and other competitive materials. Even being the most recycled plastic with high end applications like bottle-to-bottle food grade, we, representing the PET industry sector, have a lot of things to do. Most issues we have been facing are related to the absence of information at several different levels of the society. Life Cycle Inventory and Circular Economy amongst others are concepts still unknown by the non-technical citizens, and mass communication is very expensive. Greenwashing from other materials competitors will not cooperate, of course.

Concerning growing market segments, special attention is required from the new market segments for PET like beer, home and personal care, dairies, rtd juices and solid food. The challenge here is to identify the right moment when package producers or brand owners are reviewing their original production lines opening opportunities to show PET advantages. Technical support, market information and environmental performance of PET containers need to be provided.

PETplanet: It is now several years since we took a close look at the Brazilian market in PETplanet (issue 1+2/2014 ff). At that time, the PET beverage market was showing a strong growth trend. How has it developed since then?

Marçon: The local market has been following the world tendency with water rising faster during the last 10 years while soft drinks are reducing their share in the same period. Other beverages based on “healthiness concept” like teas, juices (concentrate or rtd), flavoured drinks, energisers as well as beverages for hydration are also growing.

Brazil is a traditional agricultural country producing many kinds of meals and fruits at a favourable scenario for healthy beverages. It means that there is a significant amount of people drinking natural juices and this is a challenge for industrialised/commercialised beverages that are supplying around 50% or 57% of the beverage’s consumption last year. The most important products bottled in PET containers are: soft drinks (43%), water (28%), edible oil (13%) (percentages estimated based on the last 3 years).

PETplanet: Dairies in PET was seen as a particular growth market back in 2014. Can you say something about its performance in recent years?

Marçon: Initially, about 5 years ago, the supermarket shelves were invaded by UHT milk brands bottled in PET containers, and now also yogurts and flavoured milk are replacing their original packages (polyolefin and cardboard) with PET. The low-cost production and the presentation of their products were originally their motivation, and recycling rate is now one important reason for the decision in favour of PET.

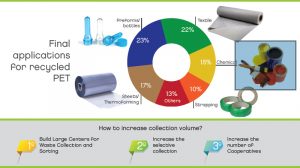

Emphasising the recycling aspects, Brazil has also producers of polyester fibres working with rPET as raw material, and this created a natural destination for the white bottles of milk and dairies, and this is motivating many brand owners to review their package mix and reinforcing the tendency to move to PET as an environmentally friendly material

PETplanet: Speaking about rPET – How strong is ‘design for recycling’ in Brazil?

Marçon: Abipet has a strong interaction with the largest brand owners and other users of PET bottles, and in the past 15 years we have been helping them develop a better “eco-design” for the PET containers. Abipet developed and published the “Directives for PET bottles recyclability” that was disseminated in package design schools and within professionals from the packaging field around the country.

PETplanet: How is the collection system for used PET bottles regulated in Brazil? And can you say something about the return rates?

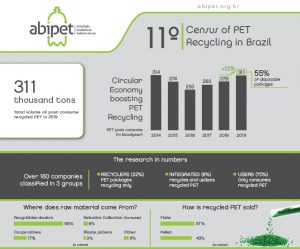

Marçon: Since more than 10 years ago, Abipet has been carrying out a PET Recycling Census with the objective of monitoring market and recycling performance in Brazil. More than a statistic search we interview almost 200 companies in different segments: recyclers, final user/application and integrated operations (from baled bottle to final product made of rPET).

In 2019, Brazil recycled 311 Kt corresponding to 55% of total disposed bottles in the urban solid waste. Many figures of the PET recycling performance can be found in the infographic. The Brazilian recycling market has a relative maturity with 80% of approximately 48 recyclers operating for over ten years. There are at least eight large recyclers with bottle-to-bottle and food-grade plants producing more than 1,500 Kt/month. All of them have suffered over the pandemic period since the automatised infrastructure supply chain for reclamation depended on people, many of whom were shielding of course.

It is important to highlight that the big brands behaviour was important during the pandemic once they met their commitments regarding the rPET content into their bottles. This attitude kept recyclers working even during the difficult times.

Unfortunately, there is still a large number of companies that have not joined the environmentally friendly design but from our point of view they are already being punished by final customers.

PETplanet: Brazil is one of the countries with the highest number of cases of coronavirus in the world. What other impact has this had on the economy so far – especially as far as the PET value chain is concerned?

Marçon: Brazil has currently around 200 million inhabitants and proportionally the number of people infected was obviously significant. On the other hand, in terms of cases/millions of people, the Brazilian index was smaller than many developed countries even during the pandemic peak.

Considering the negative aspects caused by coronavirus for the economy worldwide perhaps Brazil has not faced the worst scenario as agro-business and other important segments didn’t stop during the pandemic period. For 2021, the GDP is expected to reach 4.5%.

PET industry performance was not so bad. Final figures are not finalised yet but our estimate for 2020 is showing that virgin resin grew up 8% supplying the domestic market, exporting and covering the lack of rPET during the difficult period when reclamations was not able to supply recycling businesses.

Another important aspect regarding packages is the rupture in the supply chain observed for aluminium cans, glass bottles and polyolefins. During the second semester of 2020 and now in 2021, many brand owners changed their mix of packages increasing the PET bottles in their lines.

PETplanet: Did your members also experience any pandemic-related interruptions in supply chains, besides the recyclers’ infrastructure?

Marçon: During the worst period in 2020 (March/April) many companies stopped or significantly reduced their operations for a short period of time as a precautionary measure but it was quickly resumed once demand for beverage didn’t stop. We observe the change in the demand profile with reductions in soft drink consumption and growth in water, edible oil, detergents, alcohol-gel, cleansers and many different containers for food delivery, the majority in thermoformed trays.

An interesting experience is related to the available capacity of virgin resins that supplied all the domestic demand and exported to other countries including the USA. The total capacity of PET virgin resin in Brazil is 1,000 Kt/a, and the regular demand last year was between 600-700 Kt/a.

As I mentioned, the recyclers were significantly affected in 2020 because reclamation did not work regularly over the entire country and their raw material (disposable/baled bottles) was not enough to supply recycling plants.

PETplanet: Did you notice any changes in consumer behaviour which have had a particular impact on PET packaging during the pandemic, but also on the long term?

Marçon: All PET converters realised the change in the size of PET bottles demanded. Due to the lockdown in the cities the “on the go” consumption (small containers) was replaced for home consumption (larger bottles). Another change was the increase in PET trays used for food delivery that took advantage to increase their market share due to the lack of polyolefins to supply the converters. The same happened with detergent and other cleansers when many brands increased PET packages in their portfolio.

PETplanet: Thank you for your insights!